Hiring managers and recruiters all want the same thing: the right talent, in the right role, at the right time. But when it comes to measuring hiring speed, things get murky. Ask five recruiters to define time to fill, time to hire, or time to start, and you’ll likely hear five slightly different answers.

According to recent data, the global average time to hire is 44 days and the average interview process alone takes about 23 days. Compounding matters, top candidates tend to vanish fast: many are off the market in just 10 days.

Those stats aren’t just numbers. They highlight how small delays add up. A slow hiring process can cost you great candidates, waste recruiter bandwidth, and leave teams understaffed for longer. That’s why it’s crucial to not only measure how long you take to hire, but to break that timeline into meaningful segments.

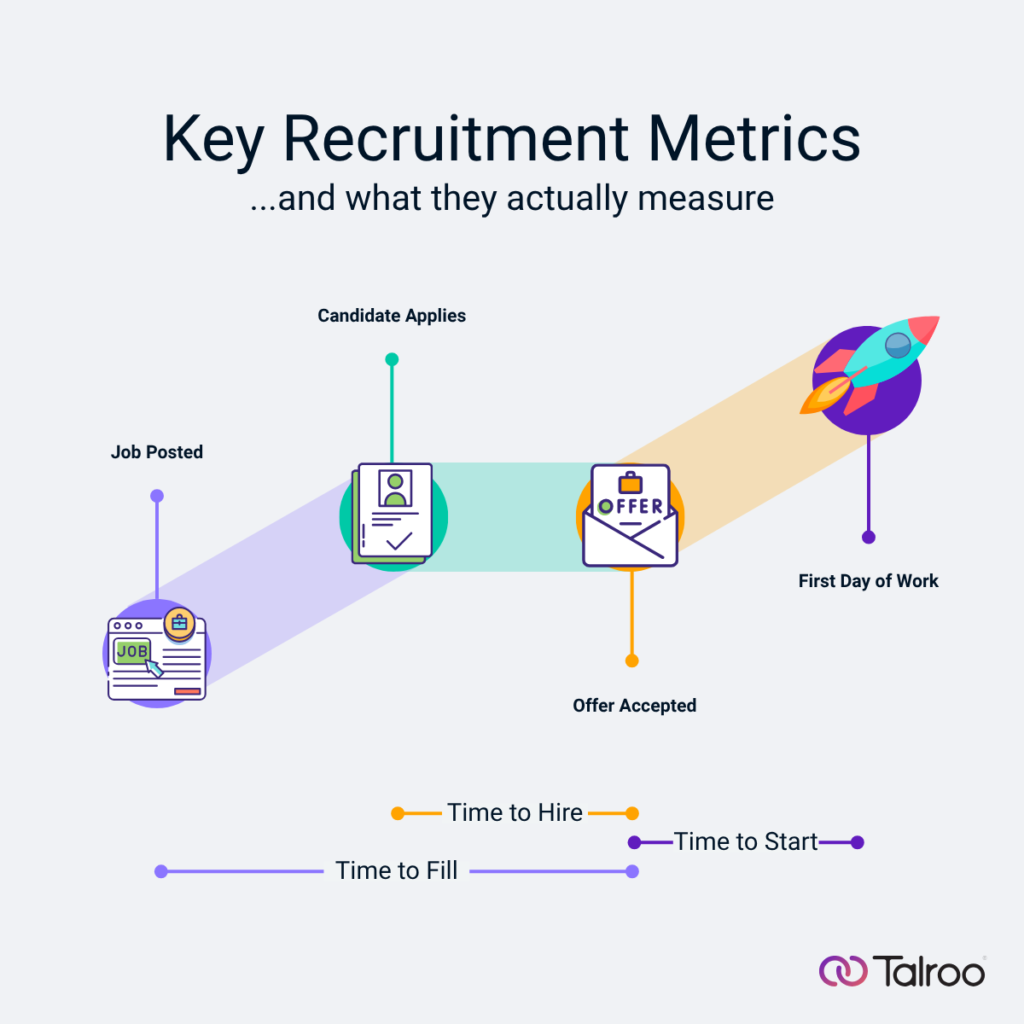

That lack of consistency makes it harder to track progress, identify bottlenecks, and forecast workforce needs. To improve recruiting outcomes, we need clarity. Let’s break down the three most common metrics—time to fill, time to hire, and time to start—and look at how they work together to tell the full story of your hiring process.

What Is Time to Fill?

Definition: Time to fill measures the total number of calendar days it takes to fill an open role. It begins when a job requisition is approved or the job is posted, and it ends when a candidate accepts the offer.

Why It Matters:

- Reflects the overall efficiency of your hiring process.

- Helps workforce planners estimate how long it will take to fill a vacancy.

- Long time to fill often means lost productivity and overextended teams.

How to Calculate It:

Time to Fill = Date candidate accepts offer – Date job requisition is approved (or posted)

Example: If a role is approved and posted on March 1 and the candidate accepts on March 25, the time to fill is 24 days.

What Is Time to Hire?

Definition: Time to hire zooms in on the candidate journey. It measures the days between when a candidate enters the pipeline—by applying, being referred, or being sourced—and when they accept the offer.

Why It Matters:

- Highlights how quickly candidates move through your process once they’re in play.

- Identifies bottlenecks in interviews, feedback loops, or decision-making.

- Provides insight into recruiter and hiring manager responsiveness.

How to Calculate It:

Time to Hire = Date candidate accepts offer – Date candidate applies (or is sourced)

Example: If a candidate applies on March 10 and accepts on March 25, the time to hire is 15 days.

What Is Time to Start?

Definition: Time to start measures the gap between when a candidate accepts the offer and when they officially begin work.

Why It Matters:

- Impacts how quickly your team regains productivity.

- Helps you anticipate onboarding needs and plan project timelines.

- Long delays may frustrate both new hires and hiring managers.

How to Calculate It:

Time to Start = Candidate’s first day of work – Date candidate accepts offer

Example: If a candidate accepts an offer on March 25 but doesn’t begin until April 15, the time to start is 21 days.

Comparing the Three Metrics

It’s easy to confuse these measures because they overlap. Think of them as nested timelines:

- Time to Fill is the broadest metric, covering everything from approval to acceptance.

- Time to Hire is a slice within that window, focused only on the candidate’s journey.

- Time to Start takes over after acceptance, measuring how long it takes for the candidate to officially join.

Here’s how they work together:

| Metric | Starts | Ends | Focus Area |

| Time to Fill | Job approved/posted | Offer accepted | Organizational efficiency |

| Time to Hire | Candidate applies/is sourced | Offer accepted | Candidate process speed |

| Time to Start | Offer accepted | First work day | Onboarding and readiness |

Why the Differences Matter

Understanding the distinctions helps you diagnose problems:

- If time to fill is long but time to hire is short, delays may be happening before the job even posts—like slow requisition approvals.

- If time to hire is long, the bottleneck is within your recruiting process—such as interview scheduling or delayed feedback.

- If time to start is long, the issue may be outside recruiting—notice periods, background checks, or onboarding capacity.

How to Use These Metrics Effectively

- Set Consistent Definitions

- Decide when each metric starts and ends for your organization.

- Document these definitions so recruiters and hiring managers measure the same way.

- Benchmark and Compare

- Track averages across roles, departments, and locations.

- Compare against industry benchmarks, but keep in mind some roles naturally take longer.

- Break Down Sub-Metrics

- For time to fill: split into approval time, sourcing time, and negotiation time.

- For time to hire: analyze time between application, screening, interview, and decision.

- For time to start: separate background checks, notice periods, and onboarding scheduling.

- Identify and Remove Bottlenecks

- Use tools like automated scheduling or standardized feedback forms.

- Simplify approvals with pre-built requisition templates.

- Start parts of onboarding before day one (digital paperwork, welcome kits).

- Communicate With Hiring Managers

- Share these metrics regularly to set realistic expectations.

- Use them to show where hiring managers can help speed things up (e.g., faster feedback).

Example: Diagnosing Delays

A useful case comes from SmartRecruiters’ 2025 Retail Benchmark Report, which shows how some retail companies improved hiring speed in high-volume roles.

- Benchmark: Retail has a median time to hire of 25 days, which is 34% lower than the global median across all industries.

- A specific retailer, Frasers Group, reduced time to hire for its high-volume retail roles from 23 days down to 9 days after applying targeted changes.

Before Optimization:

- Time to Fill (Retail average for all roles): ~38 days.

- Time to Hire (for high-volume roles): ~23 days, as reported by Frasers Group before its improvements.

- Time to Start: (Not specifically reported in that retail benchmark data; let’s assume onboarding and notice periods added ~15-20 days in that organization.)

After Changes:

- Time to Hire dropped to 9 days for those high-volume roles.

- With improved hiring manager responsiveness, streamlined interview process, and a tighter offer acceptance window, the Time to Start could similarly be reduced, say by 5-10 days, in environments where onboarding is automated.

- Overall, Time to Fill for those roles could drop from ~38 days to closer to 25-30 days when both the hiring process (Time to Hire) and post-offer Start processes are optimized.

Retail, especially high-volume roles, tends to have much faster Time to Hire compared with many other industries. Even in the same company, improvements to specific stages (candidate screening, offer acceptance windows, automating post-offer logistics) can deliver large reductions. Frasers Group’s cut from 23 → 9 days is a strong example.

Final Thoughts: Track All Three Metrics

Time to fill, time to hire, and time to start each offer valuable insights on their own. But together, they provide a 360-degree view of your hiring process, from job approval to day one.

Tracking all three helps you:

- Forecast more accurately.

- Spot inefficiencies across the process.

- Improve candidate experience.

- Get talent in the door faster so your teams can perform at their best.

In today’s competitive labor market, speed and efficiency aren’t optional—they’re a strategic advantage. By defining, measuring, and improving these three metrics, recruiters and employers can move from reactive hiring to proactive workforce planning.

If you enjoyed this article, you might also like:

Must-Have Recruiting Metrics to Show Off to Your Boss | Talroo

Recruiting Metrics: Applicant and Interview to Hire Ratios | Talroo